The Cheat Sheet for this blog – You may find it helpful!

Overview of the AI Market

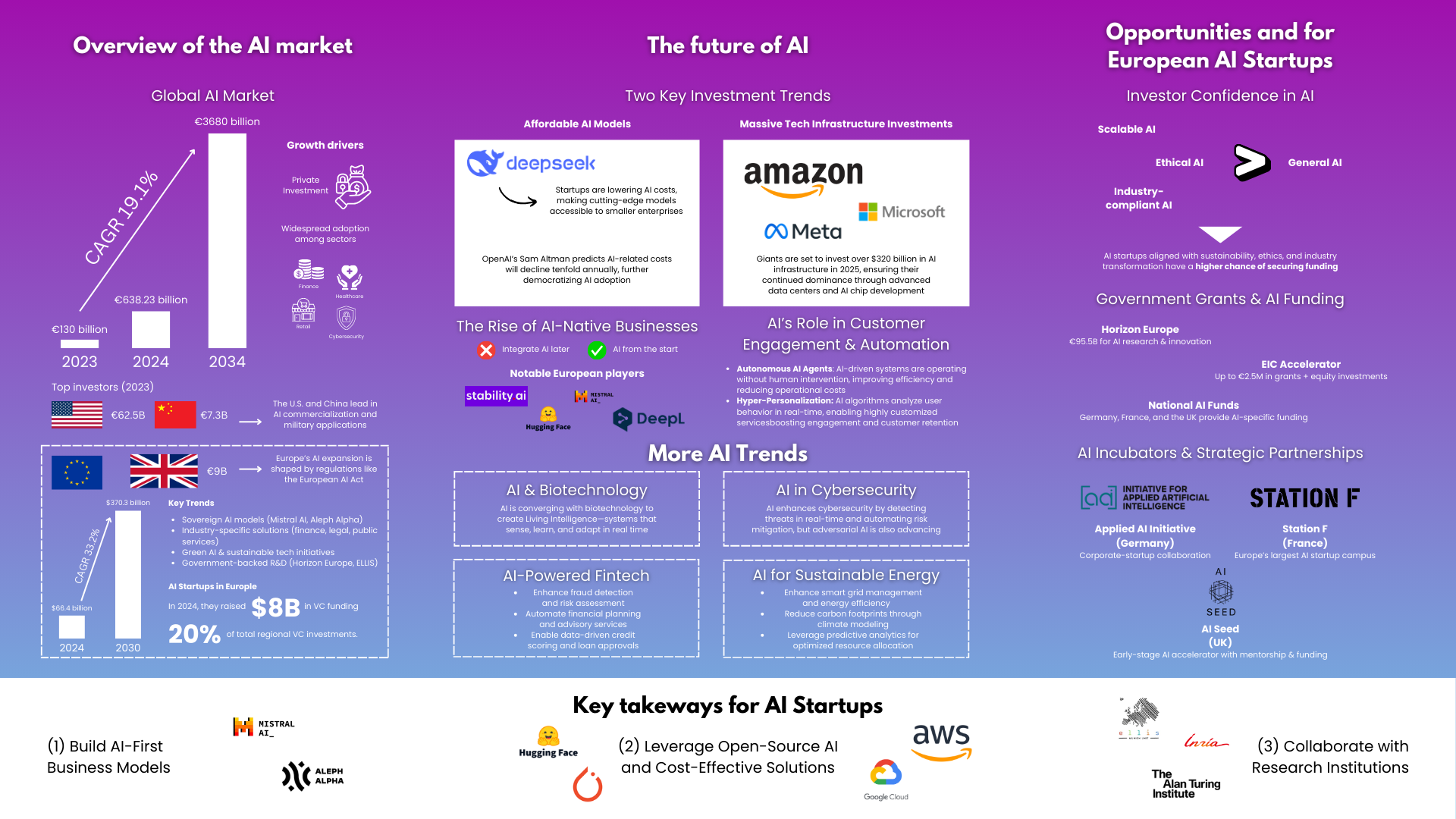

The AI market is expanding at an unprecedented pace, transforming industries and reshaping the global economy. With billions of dollars pouring into AI research and development, competition is intensifying among the world’s biggest tech players. But the AI landscape is not just about large corporations—Europe is emerging as a formidable force, driven by regulations, sovereign AI models, and ethical considerations. Meanwhile, startups across the globe are disrupting traditional industries with AI-native business models and cutting-edge innovations.

Who will lead the next phase of AI development? How will the balance between regulation, competition, and innovation shape the future? The AI race is accelerating, and its impact will reach far beyond what we can predict today.

Global AI Market Overview

The global artificial intelligence (AI) market has experienced a dramatic surge in growth over the past few years. In 2023, the market was valued at €130 billion, but by 2024, it had reached an impressive $638.23 billion, marking a significant increase. Projections indicate that by 2034, the market will expand to approximately $3.68 trillion, growing at a compound annual growth rate (CAGR) of 19.1%. This rapid growth is primarily driven by heavy private sector investments and widespread AI adoption across industries such as finance, healthcare, retail, and cybersecurity.

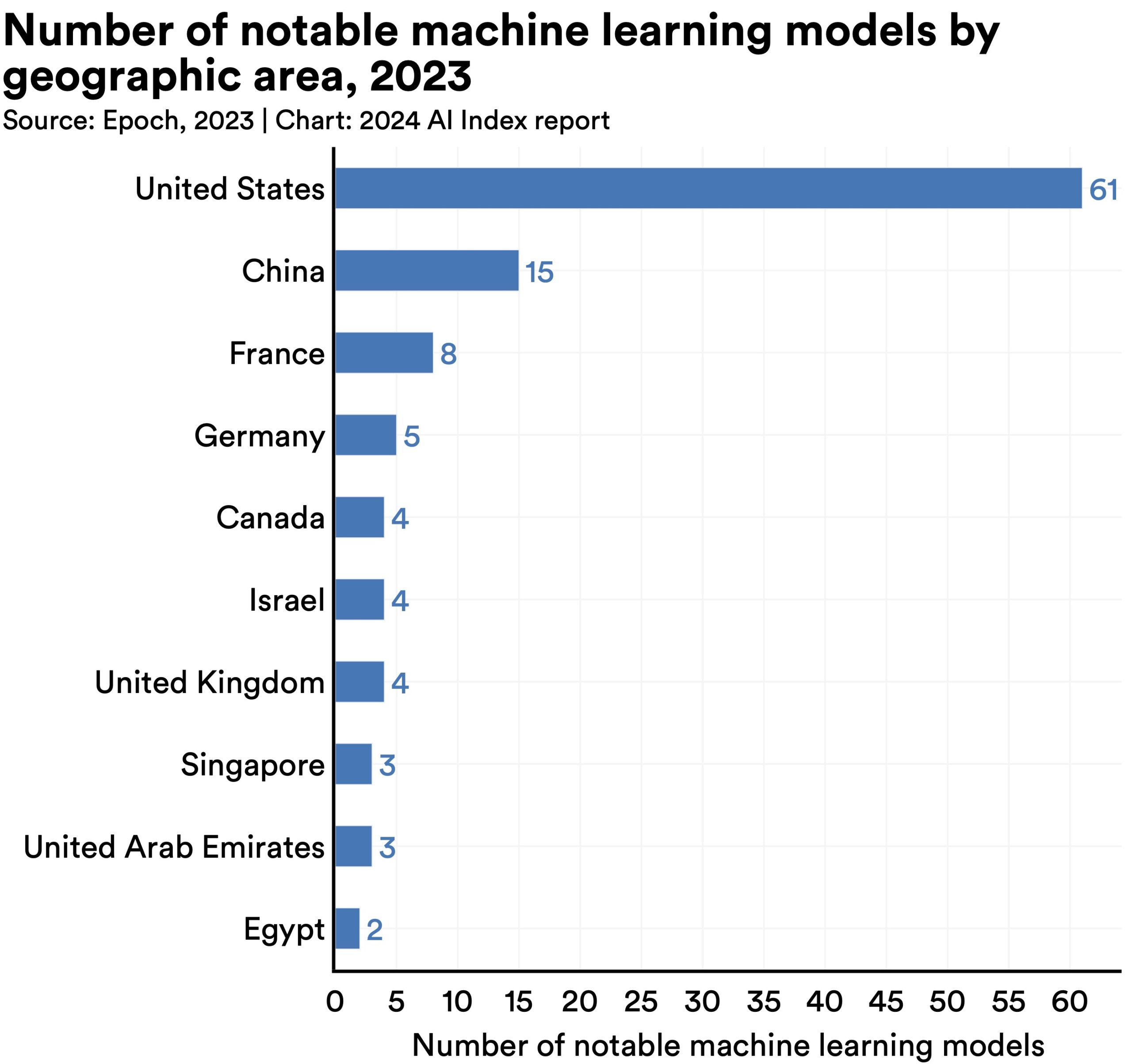

The United States remains the dominant force in global AI investment, attracting €62.5 billion in private funding in 2023, followed by China with €7.3 billion. Meanwhile, the European Union (EU) and the United Kingdom collectively secured €9 billion, reflecting Europe’s growing influence in the sector.

While the United States and China continue to lead in AI investments and research, their focus remains on scalability and commercial AI applications, with companies such as OpenAI, Google DeepMind, and Baidu AI spearheading advancements. The AI race between these two nations is heavily driven by big tech, aggressive innovation, and government-backed AI development, particularly in military, autonomous systems, and deep learning models.

AI Market in Europe: Trends and Growth Projections

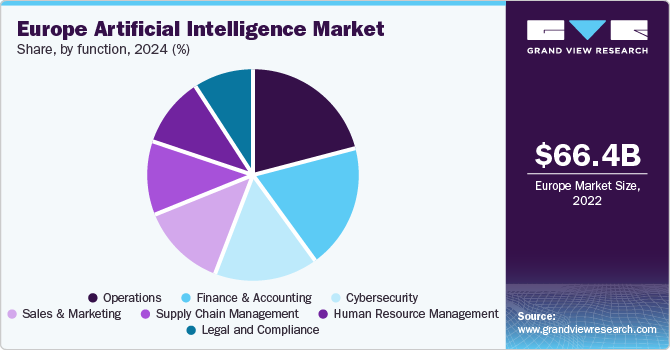

In contrast to the global AI landscape dominated by U.S. and Chinese firms, Europe has been positioning itself as a strong and regulated player in AI development. In 2024, the European AI market was valued at $66.4 billion, and it is expected to grow at a CAGR of 33.2% from 2025 to 2030, reaching $370.3 billion by 2030. This growth outpaces the global average, highlighting Europe’s increasing role in AI-driven innovation, enterprise solutions, and ethical AI development.

Unlike the U.S. and China, Europe’s AI expansion is heavily shaped by government regulations and ethical considerations. The European AI Act, one of the world’s first comprehensive AI regulations, aims to balance innovation with data privacy, fairness, and transparency, ensuring that AI deployment aligns with ethical standards. This regulatory focus creates a distinct AI landscape where sovereign AI models, industry-specific AI applications, and privacy-centric AI solutions gain traction over consumer-oriented AI products.

The Growing Role of AI in the European Startup Landscape

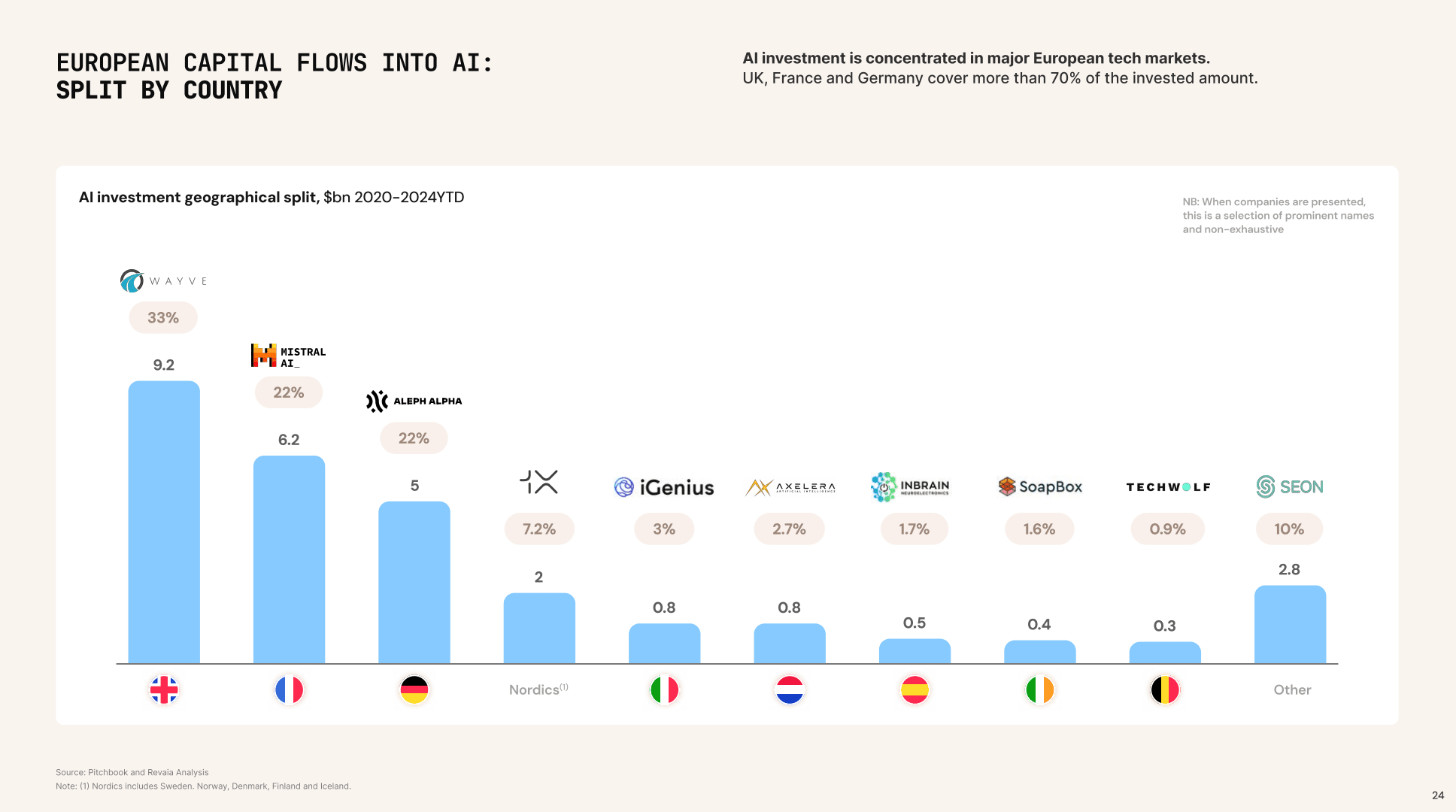

While the global AI industry is largely controlled by major corporations and government-backed research, Europe’s AI ecosystem is increasingly startup-driven. In 2024 alone, European AI startups raised $8 billion in venture capital funding, accounting for 20% of all VC investments in the region. This influx of funding indicates that investors are placing greater confidence in European AI companies, particularly in areas like healthcare, cybersecurity, fintech, and energy management.

One of the defining characteristics of AI in Europe is the emergence of sovereign AI solutions, where companies prioritize transparency, explainability, and data privacy. Unlike OpenAI and Google DeepMind, which focus on developing general AI and mass-market AI solutions, European startups such as Mistral AI, Aleph Alpha, and DeepL are designing smaller, enterprise-friendly AI models that cater to specific business needs. These models are particularly attractive to regulated industries such as finance, legal tech, and public services, where compliance with EU regulations is essential.

Another key distinction in Europe’s AI growth is the focus on sustainable AI and green technology. While AI development in the U.S. and China often prioritizes speed and computational power, European AI companies are leading efforts to reduce the carbon footprint of AI models. AI-driven energy efficiency solutions, climate modeling, and predictive analytics for renewable energy are some of the core areas where European startups are making an impact.

Moreover, Europe’s approach to AI regulation and funding fosters an environment where collaborative AI development thrives. Unlike in the U.S., where AI research is largely led by private enterprises, Europe promotes strong partnerships between startups, academic institutions, and governmental agencies. Programs such as Horizon Europe, the European AI Alliance, and ELLIS (European Laboratory for Learning and Intelligent Systems) provide AI startups with grants, resources, and research collaborations, enabling them to compete globally while adhering to ethical AI standards.

The Future of AI: Democratization, New Business Models, and Industry Disruption

AI is shifting from the hands of tech giants to a broader ecosystem of startups, enterprises, and governments. AI-native businesses are reshaping industries, while autonomous AI and hyper-personalization redefine customer engagement.

But as AI becomes more accessible, who will truly benefit? Will it level the playing field or strengthen corporate dominance through massive investments? Beyond business, AI is driving change in cybersecurity, fintech, biotech, and climate tech, blurring industry lines and setting the stage for a new era of innovation—or competition.

“AI for Everyone”: The Two Key Investment Trends Shaping AI Today

The AI landscape is experiencing a fundamental shift, driven by two key investment trends that are reshaping market dynamics: the rise of cost-effective AI models and massive infrastructure investments by tech giants.

On one end, the emergence of affordable AI models is breaking down traditional barriers to entry. A prime example is DeepSeek, a Chinese AI startup that has introduced DeepSeek-R1, an AI model that rivals leading U.S. counterparts but at a fraction of the cost. This disruptive innovation is making advanced AI more accessible to startups and smaller enterprises. Supporting this shift, OpenAI’s CEO Sam Altman predicts that AI-related costs will decrease tenfold annually, accelerating adoption across industries and democratizing AI access like never before.

Meanwhile, at the other end of the spectrum, tech giants are doubling down on AI infrastructure to maintain their dominance. Companies such as Amazon, Microsoft, Alphabet, and Meta are collectively set to invest over $320 billion in 2025 to expand data centers and develop specialized AI chips. These investments highlight their commitment to pushing AI capabilities forward and securing their leadership in an increasingly competitive market.

As AI becomes more affordable and accessible across all budget levels, the market is set for a new wave of competition and innovation. While startups and smaller businesses gain unprecedented opportunities to integrate AI, industry leaders will continue to invest heavily in cutting-edge AI advancements to sustain their competitive edge. This convergence of cost-efficient AI democratization and large-scale infrastructure investments is driving an era where AI is truly for everyone, fueling rapid transformation across industries.

The Rise of AI-Native Businesses: Reshaping Industries with AI-First Models

As AI becomes more accessible and deeply integrated into business operations, a new generation of companies is emerging—AI-native businesses. Unlike traditional firms that incorporate AI as an afterthought, these companies are built from the ground up with AI at their core, enabling continuous learning, adaptation, and automation from day one. Leading the way in Europe are companies like Stability AI, Mistral AI, Hugging Face, and DeepL, which are driving advancements in generative AI and shaping a competitive, diverse AI landscape. These AI-native businesses leverage deep automation, allowing them to scale rapidly, improve operational efficiency, and make more data-driven decisions—giving them a strong competitive edge in the market.

At the same time, established tech giants like IBM are taking a different approach, shifting their focus towards specialized AI models tailored for specific industry applications, such as customer service and healthcare. Instead of competing with large, generalized AI systems, they are prioritizing practical, use-case-driven AI solutions that cater to enterprise needs, emphasizing precision, compliance, and efficiency.

This divergence in AI adoption strategies—between AI-native startups pioneering disruptive innovations and legacy firms optimizing industry-specific AI solutions—is shaping the future of AI-powered business models, driving both radical transformation and specialized advancements across various sectors.

Customer-Centric AI: Enhancing Service, Personalization, and Efficiency

Generative AI has moved beyond theoretical innovations to become a transformative force across industries. A major outcome of this shift is the rise of Autonomous AI agents, capable of performing tasks independently without human intervention. These intelligent systems are gaining traction across Europe, particularly in customer service, finance, and healthcare, where they streamline operations and reduce reliance on human oversight. With increasing venture capital investment in AI agent startups, this marks a turning point toward fully autonomous AI-driven business models that enhance operational efficiency while maintaining high service quality.

Beyond automation, AI is also revolutionizing customer engagement through hyper-personalization. AI-driven algorithms can now analyze user behavior and preferences in real-time, tailoring services and experiences to individual needs. This trend is already reshaping healthcare, e-commerce, and entertainment, allowing businesses to offer highly customized interactions that drive retention and satisfaction.

By placing the customer at the center, AI is not just improving efficiency—it is redefining how businesses connect, serve, and engage with their audiences in an increasingly intelligent and automated world.

Opportunities and Key Takeaways for Startups in the European AI Market

As AI continues to transform industries, startups in Europe have an unprecedented opportunity to leverage AI-driven innovation, secure funding, and build disruptive business models. With increasing investor confidence, government-backed initiatives, and a strong collaborative ecosystem, European startups are well-positioned to compete in the global AI landscape.

How European Investors are Backing AI Innovation

Venture capital investment in AI startups across Europe has surged in recent years. In 2024, AI startups in Europe secured $8 billion in venture capital funding, accounting for 20% of all VC investments in the region. This influx of capital demonstrates the growing confidence investors have in AI-driven businesses.

European investors are particularly interested in AI startups that address industry-specific challenges in healthcare, fintech, cybersecurity, and sustainability. Unlike the U.S., where funding tends to favor general AI applications, European investors prioritize scalable, ethical, and industry-compliant AI solutions.

Some of the most active VC firms funding AI innovation in Europe include:

- Balderton Capital (investing in AI-driven enterprise solutions)

- Point Nine Capital (focusing on SaaS and AI-powered automation)

- EQT Ventures (supporting AI-native startups in finance, healthcare, and robotics)

For AI startups, securing investment requires more than just an innovative idea—it demands a clear AI-first business strategy, regulatory compliance, and strong market positioning.

Government Grants and AI-Specific Funding Initiatives

The European Union and national governments actively support AI startups through grants, subsidies, and funding programs. Unlike private investments, government-backed funding provides startups with non-dilutive capital (funding that does not require giving up equity) to develop and scale AI-driven solutions.

Key AI funding programs include:

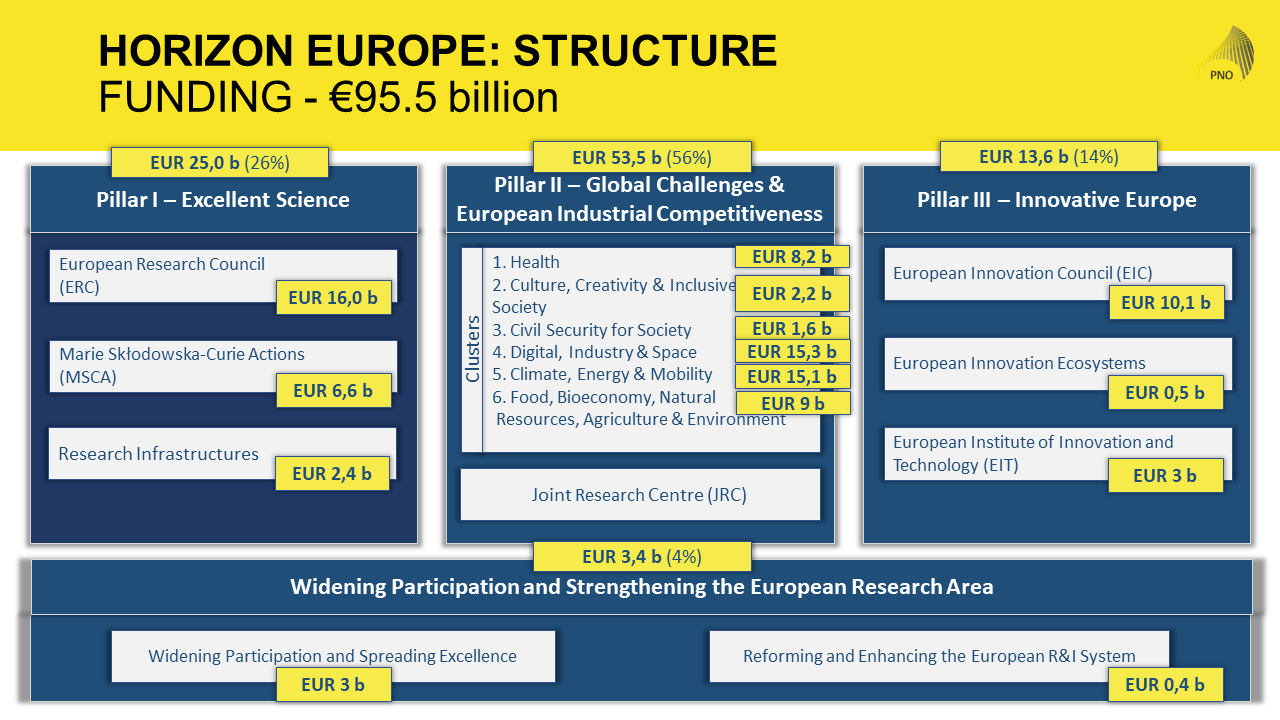

- Horizon Europe: The EU’s largest R&D funding program, providing grants of up to €95.5 billion for AI research and innovation projects.

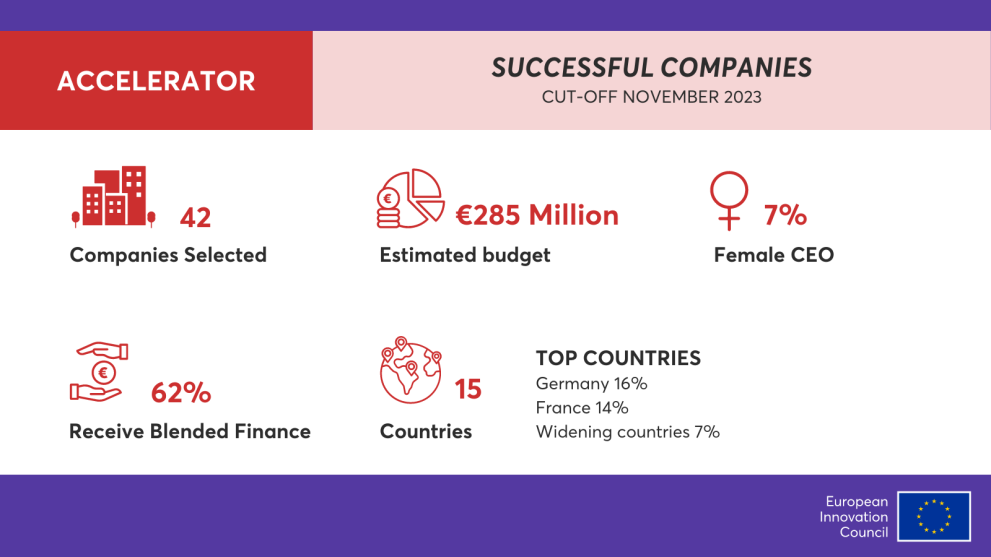

- EIC Accelerator: A program under the European Innovation Council that offers equity-free grants of up to €2.5 million and additional equity investments.

- National AI Strategies: Many European countries, including Germany, France, and the UK, have dedicated AI investment funds supporting local AI startups.

Startups that align with AI for sustainability, ethics, and industry transformation have a greater chance of securing funding from these initiatives.

Strategic Partnerships and AI Incubators for Startups

Beyond funding, Europe provides a thriving ecosystem of AI incubators, accelerators, and research partnerships that help startups scale quickly. Unlike in the U.S., where startups often grow independently, European AI startups benefit from collaborative partnerships with universities, research institutions, and government-backed AI labs.

Top AI Incubators and Accelerators in Europe:

- Applied AI Initiative (Germany) – A major AI innovation hub fostering collaboration between startups and corporates.

- Station F (France) – Europe’s largest startup campus, hosting AI startups developing next-gen solutions.

- AI Seed (UK) – An early-stage AI accelerator providing capital, mentorship, and industry connections.

These programs not only provide funding but also connect startups with AI researchers, large enterprises, and policymakers, helping them navigate the complex European regulatory landscape while gaining access to industry insights.

Key Takeaways for Startups in the European AI Market

Building AI-First Business Models

AI is no longer just a feature—it’s the foundation of the next generation of startups. Unlike traditional businesses that integrate AI into their existing operations, AI-first startups are built with AI at their core.

Successful AI-first startups focus on:

- Automated decision-making and self-improving algorithms

- AI-driven personalization to enhance customer experiences

- Industry-specific AI applications (healthcare diagnostics, AI-powered legal tech, etc.)

Startups like Mistral AI (France) and Aleph Alpha (Germany) have built their entire business models around AI-native technology, ensuring scalability and competitiveness in the global AI market.

Leveraging Open-Source AI and Cost-Effective Solutions

One of the biggest challenges for startups is AI infrastructure costs. However, open-source AI models and cloud-based AI platforms are making it easier for startups to develop AI solutions without large capital investments.

Key strategies include:

- Using open-source AI frameworks like Hugging Face or PyTorch to reduce development costs.

- Leveraging cloud AI services (AWS, Google Cloud AI, Azure AI) to avoid expensive in-house infrastructure.

- Adopting cost-efficient AI models such as smaller, fine-tuned LLMs instead of massive, resource-heavy AI models.

Collaborating with Research Institutions and AI Think Tanks

Unlike in the U.S., where AI research is mostly led by private companies, Europe fosters strong collaborations between startups and research institutions. Partnering with universities and AI research labs gives startups access to cutting-edge AI advancements, talent, and funding opportunities.

Notable AI research networks in Europe include:

- ELLIS (European Laboratory for Learning and Intelligent Systems) – A major research hub supporting AI talent and startup collaborations.

- Turing Institute (UK) – Leading AI research in data science and machine learning.

- INRIA (France) – A French research institute focused on AI, robotics, and deep learning.

Collaborating with these institutions not only accelerates AI product development but also helps startups stay ahead of regulatory changes and compliance requirements.

Case Studies of Successful AI Startups in Europe

Several European startups have successfully navigated the AI landscape and built scalable, globally competitive AI businesses:

- Mistral AI (France) – A rising competitor to OpenAI, developing cost-effective, open-weight AI models tailored for European businesses.

- DeepL (Germany) – AI-powered translation startup that has outperformed Google Translate in quality and accuracy.

- Aleph Alpha (Germany) – A sovereign AI company building privacy-compliant, explainable AI solutions for enterprise and government use.

- Synthesia (UK) – AI-powered video generation startup revolutionizing content creation.

These case studies demonstrate that AI startups in Europe can thrive by focusing on specialized, cost-efficient, and regulation-friendly AI solutions rather than competing directly with global AI giants.

Conclusion: The Future of AI – Growth, Innovation, and Competition

The AI market is experiencing unprecedented growth, driven by rapid innovation, increasing investments, and expanding accessibility across industries. The global AI landscape, led by the U.S. and China, continues to evolve, while Europe is emerging as a strong, regulation-driven player, fostering ethical AI development and specialized solutions.

As AI becomes more cost-effective and widely adopted, businesses of all sizes—from AI-native startups to industry giants—are leveraging its power to transform industries, enhance efficiency, and drive customer-centric solutions. The rise of AI-powered fintech, cybersecurity, biotechnology, and sustainable energy solutions signals the far-reaching impact AI will have in the years ahead.

Looking forward, competition will intensify, creating new opportunities for innovation, collaboration, and market disruption. Companies that embrace AI-first strategies, invest in ethical and specialized AI applications, and leverage emerging technologies will be best positioned to lead the next wave of AI-driven transformation.