In recent years, the financial technology (Fintech) industry has experienced exponential growth, reshaping the landscape of banking and financial services. Fintech innovations have introduced unprecedented levels of convenience and accessibility, revolutionizing how individuals and businesses manage their finances. However, amidst this digital transformation, the security of sensitive financial data and transactions has emerged as a paramount concern. This article aims to explore the intricate relationship between Fintech and cybersecurity, analyzing the key challenges faced by Fintech companies in ensuring cybersecurity and proposing effective solutions to navigate these challenges.

I. The Landscape of Fintech and Cybersecurity

Definition of Fintech

Fintech, short for financial technology, refers to the integration of technology into financial services to enhance efficiency, accessibility, and innovation. From mobile banking applications to peer-to-peer lending platforms, Fintech encompasses a broad spectrum of innovations that have transformed the traditional banking and financial sectors.

Significance of Cybersecurity in Fintech

In the digital era, cybersecurity plays a pivotal role in safeguarding sensitive financial data and transactions within the Fintech ecosystem. As Fintech companies leverage digital platforms to deliver services and process transactions, they become prime targets for cyberattacks. The protection of customer data, financial assets, and the integrity of transactions is essential to maintaining trust and credibility in the Fintech industry.

Statistics and Trends

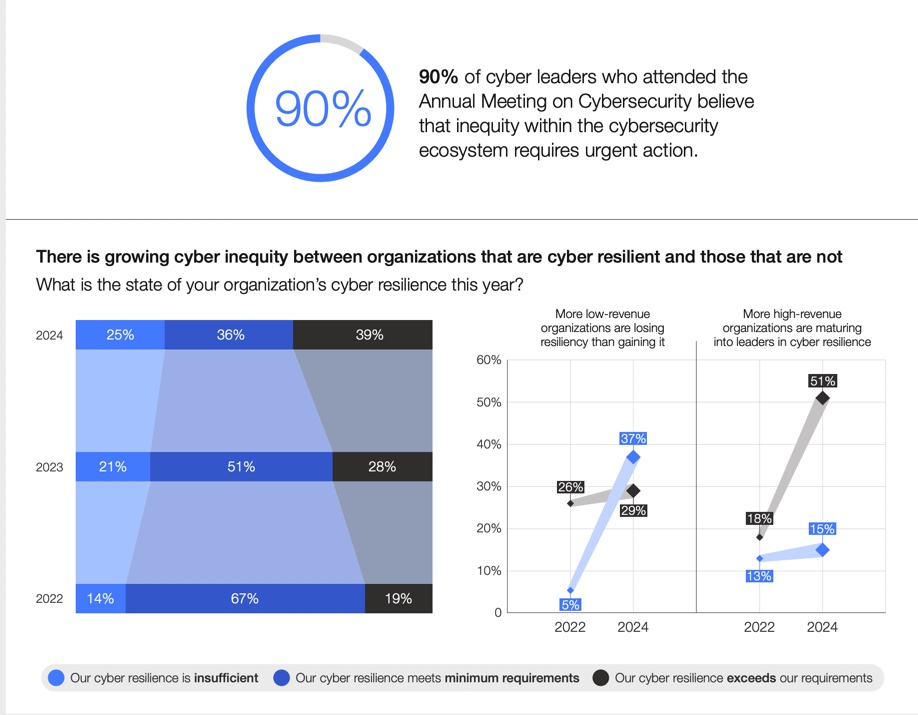

Figure 1: The diagram illustrates the disparity in cyber resilience between organizations with different revenue levels over the years 2022 and 2024 (World Economic Forum, 2024)

A recent prestigious report on the importance of cybersecurity in the fintech industry highlights the growing need for robust security measures as fintech companies increasingly rely on digital technology. The “Global Cybersecurity Outlook 2024” from the World Economic Forum outlines significant cybersecurity trends and their impact on industries, including fintech. It underscores the critical importance of managing cybersecurity risks amidst the rising use of digital solutions in financial services. For more insightful information about Global Cybersecurity Outlook in 2024, please visit World Economic Forum.

II. Key Challenges in Fintech Cybersecurity

1. Data Breaches and Security Threats

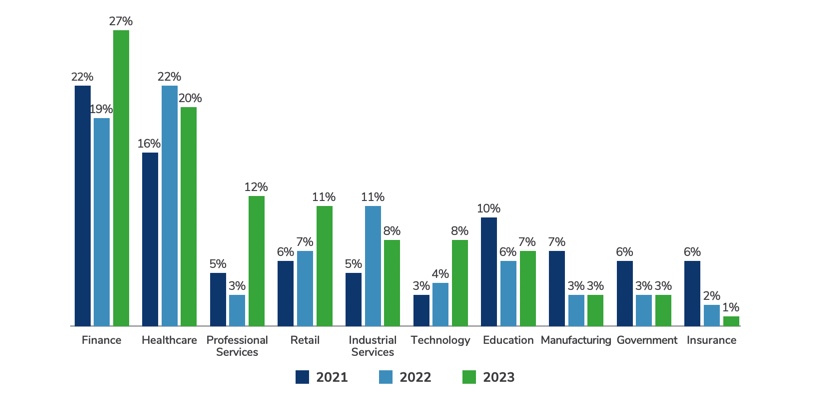

Figure 2: The chart displays the distribution of data breaches from 2021 to 2023 across different industries (Kroll, 2023)

A recent study conducted by Kroll and presented in their 2023 Data Breach Outlook report has shed light on the prevalence of third-party related cybersecurity incidents. After analyzing thousands of such breaches, the study has revealed that financial companies continue to be the most frequent victims of these security violations over the past year.

🔑 Common Types of Data Breaches

Fintech companies face a myriad of security threats, ranging from phishing attacks to ransomware and insider threats. These breaches can result in unauthorized access to sensitive customer information, financial fraud, and reputational damage.

🔑 Prominent Data Breaches

Recent breaches at major entities like Bank of America and Microsoft Azure illustrate the challenges and necessary responses faced by the fintech sector.

Bank of America Data Breach: A Case of Third-Party Vulnerability (February 2024)

In February 2024, Bank of America customers were unsettled to learn of a data breach resulting from a cyberattack on Infosys McCamish Systems, an Infosys subsidiary responsible for data processing. The breach exposed sensitive information including names, social security numbers, and account details. This incident highlights a crucial vulnerability in the financial sector—third party and subcontractor relationships, which are often the weakest link in the security chain.

The breach underscores the necessity for stringent security protocols not only within primary financial institutions but also across their associated networks. Ensuring that third-party vendors adhere to high security standards is essential, as their weaknesses can directly impact the primary institutions they serve.

Microsoft Azure Data Breach: The Cloud’s Achilles Heel (February 2024)

Simultaneously, Microsoft Azure experienced a significant breach where sophisticated cyberattackers compromised the accounts of hundreds of senior executives. Leveraging phishing tactics and cloud account takeovers, the attackers exploited a critical vulnerability in Microsoft Exchange servers. This breach sheds light on the critical need for robust cloud security measures.

Cloud services, favored for their scalability and flexibility, are increasingly adopted by fintech companies. However, their widespread use also presents broad targets for cyberattacks. This incident serves as a reminder of the importance of securing cloud infrastructures and implementing multi-layered security strategies to protect sensitive data.

🔑 Rising Frequency and Cost

Statistics reveal a troubling trend of increasing frequency and cost of cybersecurity incidents in the Fintech sector. As cyber threats continue to evolve, Fintech companies must enhance their security measures to mitigate risks effectively and protect both company assets and customer data.

2. Compliance and Regulatory Issues

🔑 Complex Regulatory Landscape

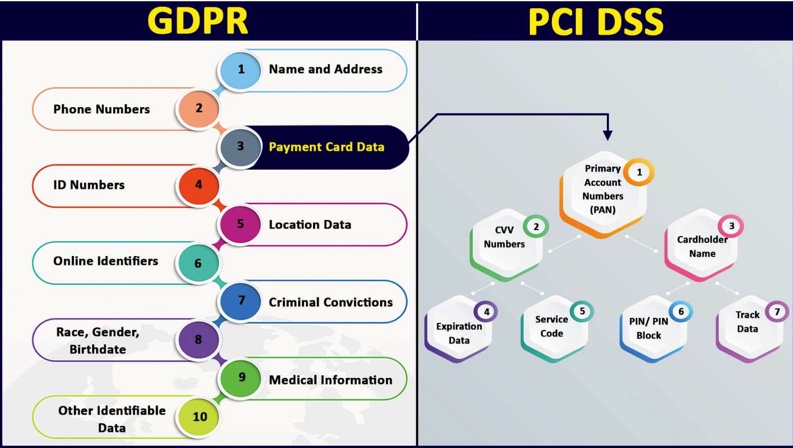

Fintech operations are subject to a complex regulatory environment, encompassing regulations such as GDPR, PCI-DSS, and PSD2. Compliance with these regulations poses significant challenges for Fintech companies, particularly those operating across multiple jurisdictions.

Figure 3: The scope of PCI DSS and GDPR (Sahoo, 2023)

🔑 Consequences of Non-compliance

Non-compliance with regulatory requirements can lead to severe consequences, including hefty fines, legal penalties, and reputational damage. Maintaining compliance is essential to upholding trust and credibility within the industry and avoiding detrimental impacts on business operations.

3. Technological Vulnerabilities

🔑 Risks Associated with Fintech Technologies

Fintech innovations such as mobile banking apps, digital wallets, and blockchain introduce new technological vulnerabilities. These vulnerabilities may include security flaws, third-party API vulnerabilities, and risks associated with emerging technologies like AI and IoT.

🔑 Examples of Cybersecurity Incidents

In 2023, the LinkedIn article titled “Common Vulnerabilities in the Fintech Industry” provides valuable insights into the specific vulnerabilities that Fintech companies often encounter. By examining common weaknesses and exploitable points within Fintech systems, the article highlights the importance of proactive cybersecurity measures to mitigate these risks effectively.

One prevalent vulnerability outlined in the article is the susceptibility of Fintech platforms to phishing attacks. Malicious actors often employ sophisticated phishing techniques to deceive users into revealing sensitive information such as login credentials or financial details. By impersonating legitimate Fintech companies or institutions, attackers can trick users into providing access to their accounts, leading to potential data breaches or financial fraud.

Additionally, the article discusses the risk posed by insecure application programming interfaces (APIs) within Fintech systems. APIs facilitate the seamless exchange of data between different software applications, but if not properly secured, they can serve as entry points for cyberattacks. Vulnerabilities in APIs may allow attackers to exploit loopholes and gain unauthorized access to sensitive data or manipulate financial transactions, compromising the integrity of Fintech platforms.

III. Solutions for Enhancing Fintech Cybersecurity

1. Robust Authentication Mechanisms

Multi-factor authentication (MFA) serves as a critical defense against unauthorized access in Fintech platforms. Case studies showcased in Digital Defynd (2023) provide compelling evidence of MFA’s effectiveness in thwarting account takeover and fraudulent activities. One such case study involved a prominent Fintech company that implemented MFA across its digital banking platform. Following the implementation, instances of account compromise significantly decreased, demonstrating the efficacy of MFA in bolstering security measures. Moreover, the adoption of biometric authentication methods, such as fingerprint recognition and facial recognition, further fortified the authentication process, ensuring a seamless yet robust user experience.

2. Encryption and Data Protection

In the realm of Fintech, end-to-end encryption serves as a cornerstone in safeguarding sensitive financial data. Best practices outlined in industry reports emphasize the importance of implementing robust encryption algorithms and data protection measures. Case studies cited in scholarly sources underscore the efficacy of end-to-end encryption in mitigating the risk of data breaches and unauthorized access. For instance, a study published in the Journal of Financial Technology detailed the implementation of end-to-end encryption by a leading digital payment provider. The encryption technology, coupled with stringent data masking techniques, significantly enhanced the security posture of the platform, instilling confidence among users and stakeholders alike.

3. Regulatory Compliance Frameworks

Navigating the intricate regulatory landscape governing Fintech operations requires the establishment of robust compliance programs. Academic journals and industry reports offer insights into successful compliance strategies adopted by Fintech companies. For instance, a research paper presented at the International Conference on Cybersecurity Proceedings highlighted the compliance journey of a Fintech startup. By leveraging compliance automation tools and undergoing regular third-party audits, the company achieved and maintained compliance with stringent regulatory requirements, thereby fostering trust and credibility among customers and regulatory bodies.

4. Employee Training and Awareness

Employee training programs play a pivotal role in fostering a culture of cybersecurity awareness within Fintech organizations. Scholarly articles and industry reports emphasize the significance of ongoing training initiatives in mitigating insider threats and human error. For example, a study published in the Journal of Information Security and Privacy examined the impact of employee training on cybersecurity awareness in a Fintech company. Through comprehensive training modules and simulated phishing exercises, employees became more adept at identifying potential security risks and adhering to best practices, ultimately strengthening the organization’s overall security posture.

Take Action with Smart81: Your Next Step in FinTech Cybersecurity

In the complex and ever-evolving landscape of Fintech cybersecurity, partnering with a trusted technology provider can make all the difference. Smart81 offers tailored AI solutions designed to enhance fraud detection capabilities and optimize financial operations for better efficiency and compliance.

Tailored AI Solutions

Smart81’s AI solutions are customized to address the specific cybersecurity needs of Fintech companies. Leveraging cutting-edge technologies such as machine learning and natural language processing, our solutions provide advanced threat detection and predictive analytics to safeguard against emerging cyber threats.

Enhanced Fraud Detection Capabilities

Detecting and mitigating fraudulent activities is paramount in the Fintech industry. Smart81’s AI-powered fraud detection solutions leverage advanced algorithms to analyze vast amounts of transactional data in real-time, identifying suspicious patterns and anomalies that may indicate fraudulent behavior.

Optimized Financial Operations

In addition to enhancing cybersecurity measures, Smart81’s AI solutions optimize financial operations for better efficiency and compliance. By automating manual processes and streamlining workflows, our solutions enable Fintech companies to reduce operational costs, improve productivity, and ensure regulatory compliance.

Explore the Possibilities with Smart81

Ready to take your Fintech cybersecurity strategy to the next level? Contact Smart81 today to explore how our AI solutions can transform your fraud detection strategies and optimize your financial operations. Our team of experts is dedicated to helping you navigate the complex cyber seas with confidence and ensure the security and integrity of your Fintech operations.

👉 Take the next step with Smart81 and revolutionize your Fintech cybersecurity approach. Contact us today and explore more about your Fintech Software Development Partner!

Reference list

DigitalDefynd (2023). Top 10 FinTech Case Studies [A Detailed Exploration] [2024]. [online] DigitalDefynd. Available at: https://digitaldefynd.com/IQ/fintech-case-studies/ [Accessed 23 Apr. 2024].

Kroll (2023). Data Breach Outlook: Finance Surpasses Healthcare as Most Breached Industry in 2023. [online] Kroll. Available at: https://www.kroll.com/-/media/kroll-images/pdfs/data-breach-outlook-2024.pdf [Accessed 26 Apr. 2024].

Rainbow Secure (2023). The common vulnerabilities in the Fintech Industry. [online] www.linkedin.com. Available at: https://www.linkedin.com/pulse/common-vulnerabilities-fintech-industry-rainbowsecure [Accessed 23 Apr. 2024].

Sahoo, N. (2023). PCI DSS vs GDPR: A Comparison of Data Security Standards. [online] VISTA InfoSec. Available at: https://www.vistainfosec.com/blog/pci-dss-vs-gdpr/.

World Economic Forum (2024). Global Cybersecurity Outlook 2024 J A N U A R Y 2 0 2 4 In collaboration with Accenture. [online] Available at: https://www3.weforum.org/docs/WEF_Global_Cybersecurity_Outlook_2024.pdf.