In today’s fast-paced business world, the ability to convert raw data into actionable insights is a game-changer, driving a competitive edge and strategic growth. Enter closed-loop payment systems: these innovative frameworks are revolutionizing how businesses operate, allowing for continuous refinement of strategies and processes based on real-time data. This blog post explores the transformative power of closed-loop systems and their crucial role in enabling data-driven decision-making.

The concept of closed – loop system

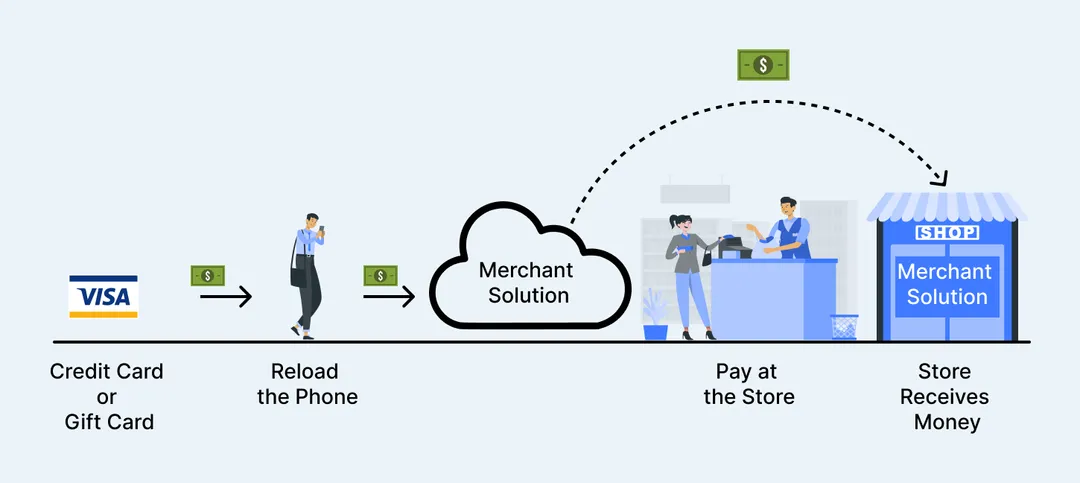

A closed-loop payment system is a financial ecosystem where transactions occur within a single, unified network, typically managed by one entity. Unlike open-loop systems, where payments pass through multiple intermediaries (such as banks and credit card networks), closed-loop systems operate within a confined environment, offering numerous benefits in terms of efficiency, security, and customer satisfaction.

Illustration 1: A closed-loop payment system

Closed – loop Payment Procedure

Data collection

The ability to effectively collect data is crucial for driving strategic growth. Data collection serves as the foundation for informed decision-making, enabling businesses to gather comprehensive and accurate information from various sources.

📌 Diverse Data Sources:

Illustration 2: Diverse Data Sources

- Customer Interactions: Data is gathered from various customer touch points, including point-of-sale systems, online transactions, customer service interactions, social media engagements, and feedback forms.

- Operational Data: Internal processes provide valuable data, such as production logs, supply chain metrics, inventory levels, and employee performance data.

- Market Intelligence: External data sources, including market research reports, competitor analysis, and economic indicators, offer insights into industry trends and market dynamics. Companies subscribe to industry publications and use analytics tools to track market movements.

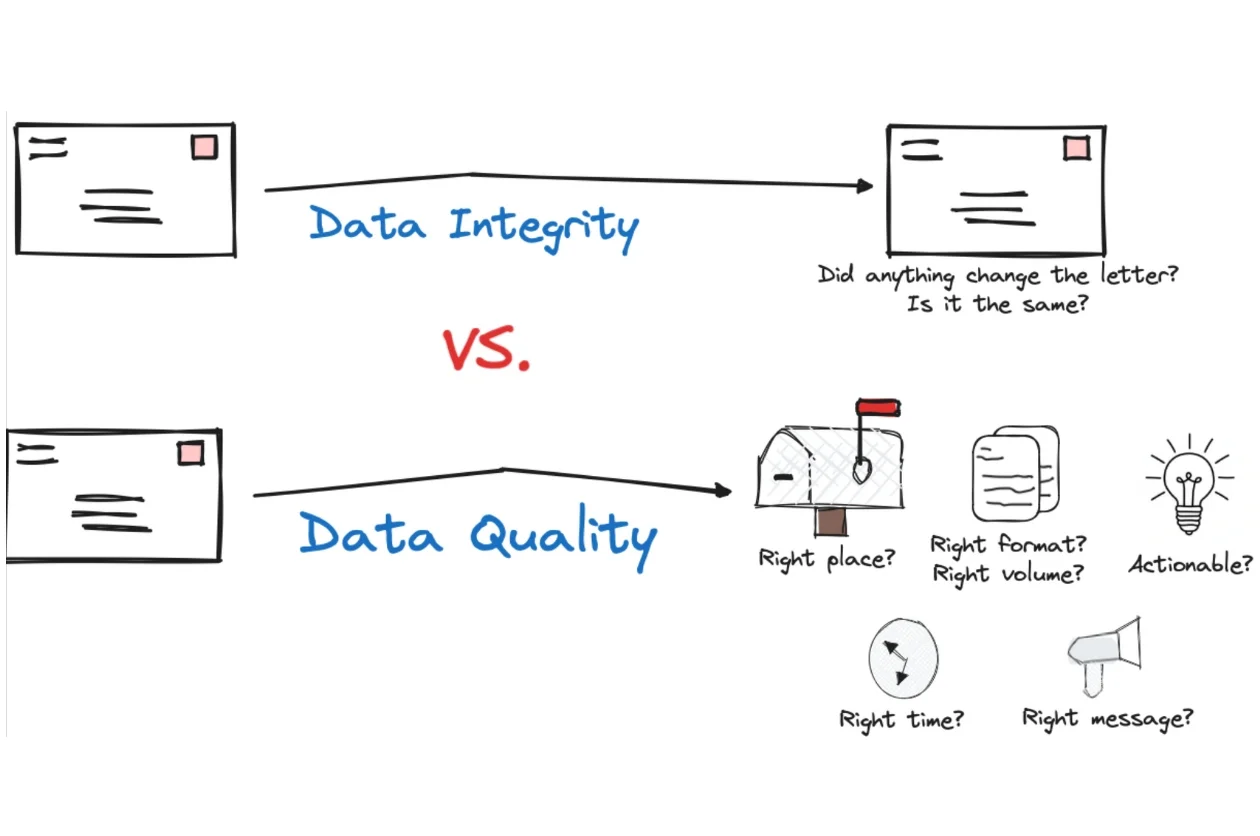

📌 Data Quality and Integrity:

Illustration 3: Data Quality and Integrity

- Accuracy: Ensuring that data is accurate and free from errors is crucial. This involves regular data validation checks and using tools to identify and correct inaccuracies.

- Completeness: Data should be comprehensive, capturing all relevant information needed for analysis. Missing data can lead to incomplete insights and flawed decision-making.

- Consistency: Standardizing data formats and ensuring consistency across different data sources helps in seamless integration and analysis.

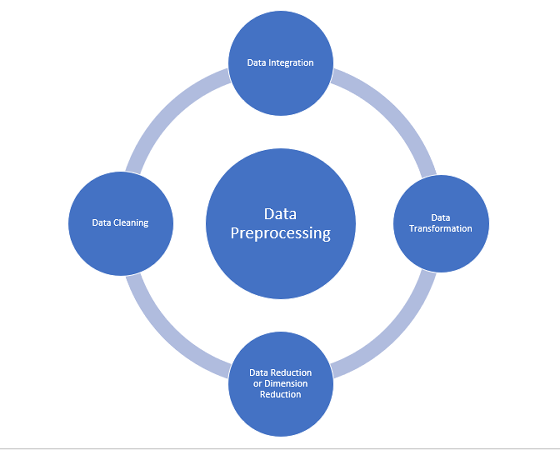

Transforming Data into Actionable Insights:

The true value lies in transforming this raw data into actionable insights that drive strategic decisions and operational improvements. This process involves sophisticated data analysis techniques and tools that convert vast amounts of data into meaningful information.

📌 Data Cleaning and Preprocessing:

- Cleaning: Removing duplicate entries, correcting errors, and handling missing values to prepare data for analysis.

- Preprocessing: Standardizing data formats and transforming raw data into a structured format suitable for analysis.

Illustration 4: Transforming Data into Actionable Insights

📌 Advanced analytical techniques: From providing a historical view of data to identify trends and patterns, then utilizing statistical models and machine learning algorithms to forecast future trends based on historical data to finally recommend actions based on predictive insights to achieve desired outcomes.

Driving Strategic Growth

Identifying Trends and Predicting Future Behaviors is the capability allows organizations to anticipate changes, capitalize on emerging opportunities, and mitigate potential risks. Here’s how businesses can effectively identify trends and predict future behaviors through advanced data analysis techniques.

📌 Trend Analysis through behavioral predictions: Predictive analytics models use historical data to forecast future behaviors and outcomes. Businesses can predict customer purchasing patterns, market shifts, and potential risks.

Illustration 5: Driving Strategic Growth

📌 Informed Decision-Making: Data-driven decision-making empowers businesses to make informed choices based on empirical evidence rather than intuition. This leads to more accurate and effective strategies.

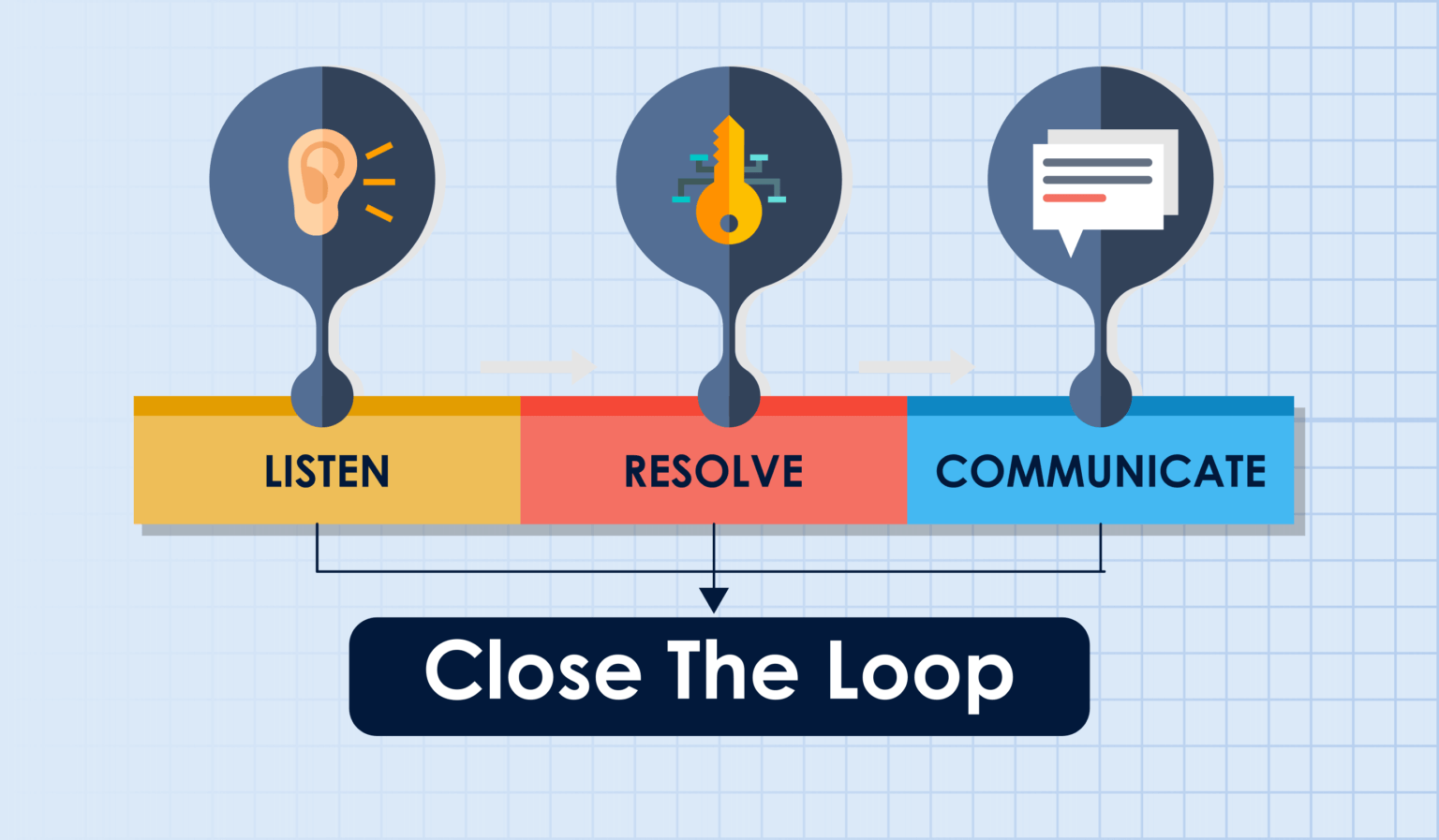

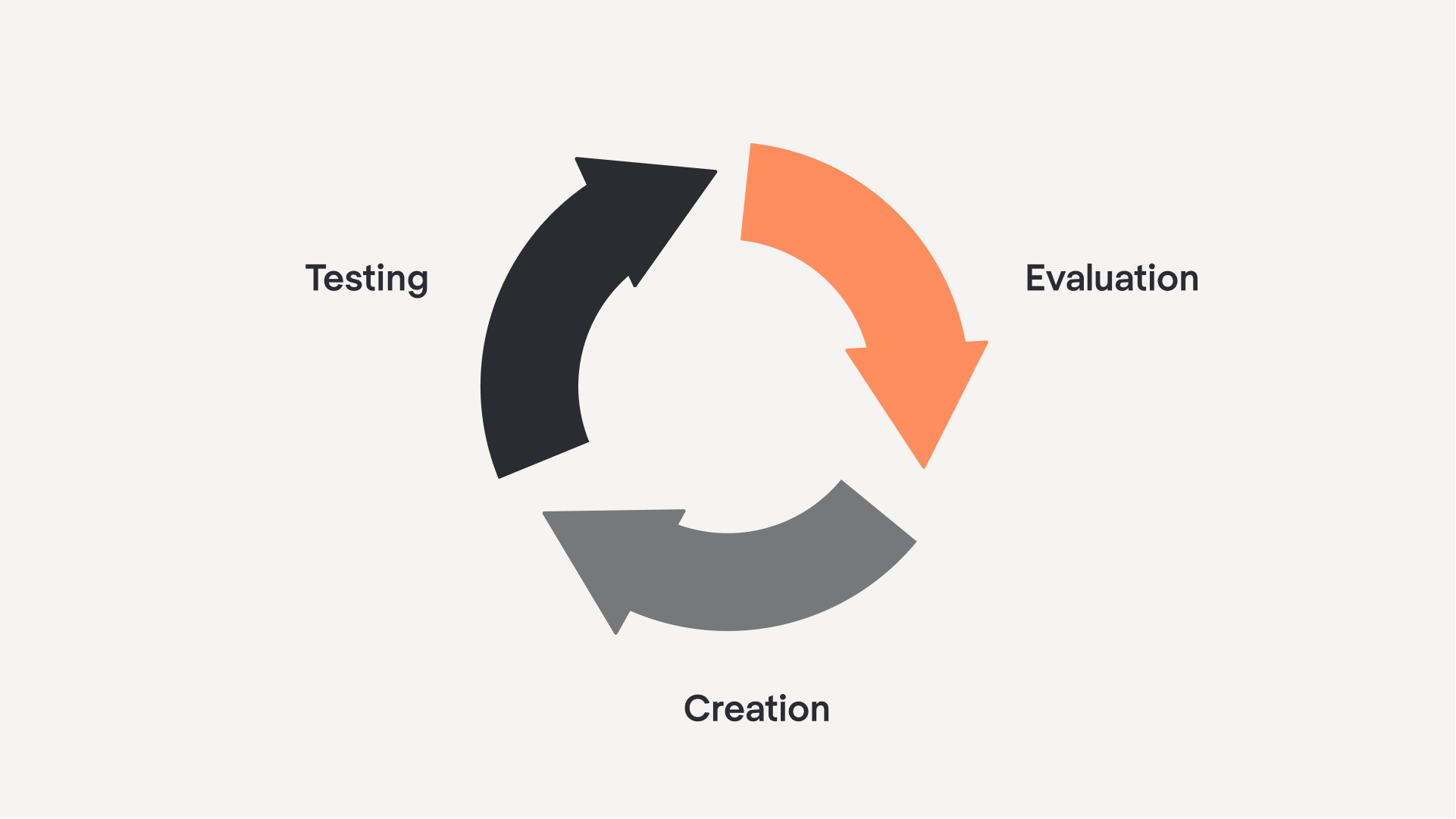

Iterative Improvement:

Refining Actions and Strategies for continuous growth or Iterative Improvement is a key aspect of closed-loop systems, enabling businesses to continuously refine their actions and strategies based on real-time data and feedback. This process involves integrating insights from each cycle back into the system, fostering a culture of ongoing enhancement and responsiveness.

Illustration 6: Iterative Improvement Process

📌 Outcome Analysis: Businesses analyze the outcomes of their actions to determine their effectiveness. This involves comparing actual performance against predefined targets and benchmarks by analyzing metrics such as conversion rates, click-through rates, and return on investment.

📌 Testing: Conducting testing allows businesses to compare the effectiveness of different strategies or actions. By testing variations, they can identify which approaches yield the best results and make data-driven decisions.

📌 Stakeholder Feedback: Gathering feedback from stakeholders, including employees, customers, and partners, provides valuable insights into the impact of actions. This qualitative data complements quantitative performance metrics.

Efficiency with Closed-Loop Systems

By integrating continuous feedback mechanisms, these systems enable organizations to harness real-time data for strategic growth and improved performance. One of the key advantages is enhanced agility, enabling companies to quickly adapt to market changes and emerging trends. This adaptability is crucial in a dynamic business environment where staying ahead of the curve can provide a significant competitive edge.

Illustration 7: Application of Closed – Loop Payment

Moreover, closed-loop systems improve decision-making processes by leveraging data-driven insights, leading to more accurate and effective strategies. These systems also enhance operational efficiency by continuously optimizing processes and reducing waste through regular feedback loops. A customer-centric approach can also be inherent in closed-loop systems so that they ensure that products and services are closely aligned with customer expectations, thereby boosting customer satisfaction and loyalty. Therefore, closed-loop systems foster a more responsive, efficient, and customer-focused business model.

With Smart81: A Path to Enhanced Efficiency and Growth

Overcoming these challenges requires a strategic approach, including investing in training, choosing scalable technologies, and fostering a data-driven culture within the organization.

Smart81 is a cutting-edge solution designed to streamline the implementation of closed-loop systems. With its user-friendly interface and robust analytical capabilities, Smart81 empowers businesses to achieve enhanced efficiency and strategic growth by:

- Unified Data Platform: Consolidates data from various sources, ensuring a comprehensive view.

- Advanced Analytics: Leverages AI and ML to provide deep insights and predictive analytics.

- Real-Time Monitoring: Offers real-time monitoring and feedback capabilities to ensure continuous improvement.

- Scalability: Designed to scale with business growth, accommodating increasing data volumes and complexity.

Join the community of forward-thinking businesses that are already leveraging Smart81’s advanced systems and innovative tools. Don’t miss out on the opportunity to optimize your business processes and achieve unparalleled growth.